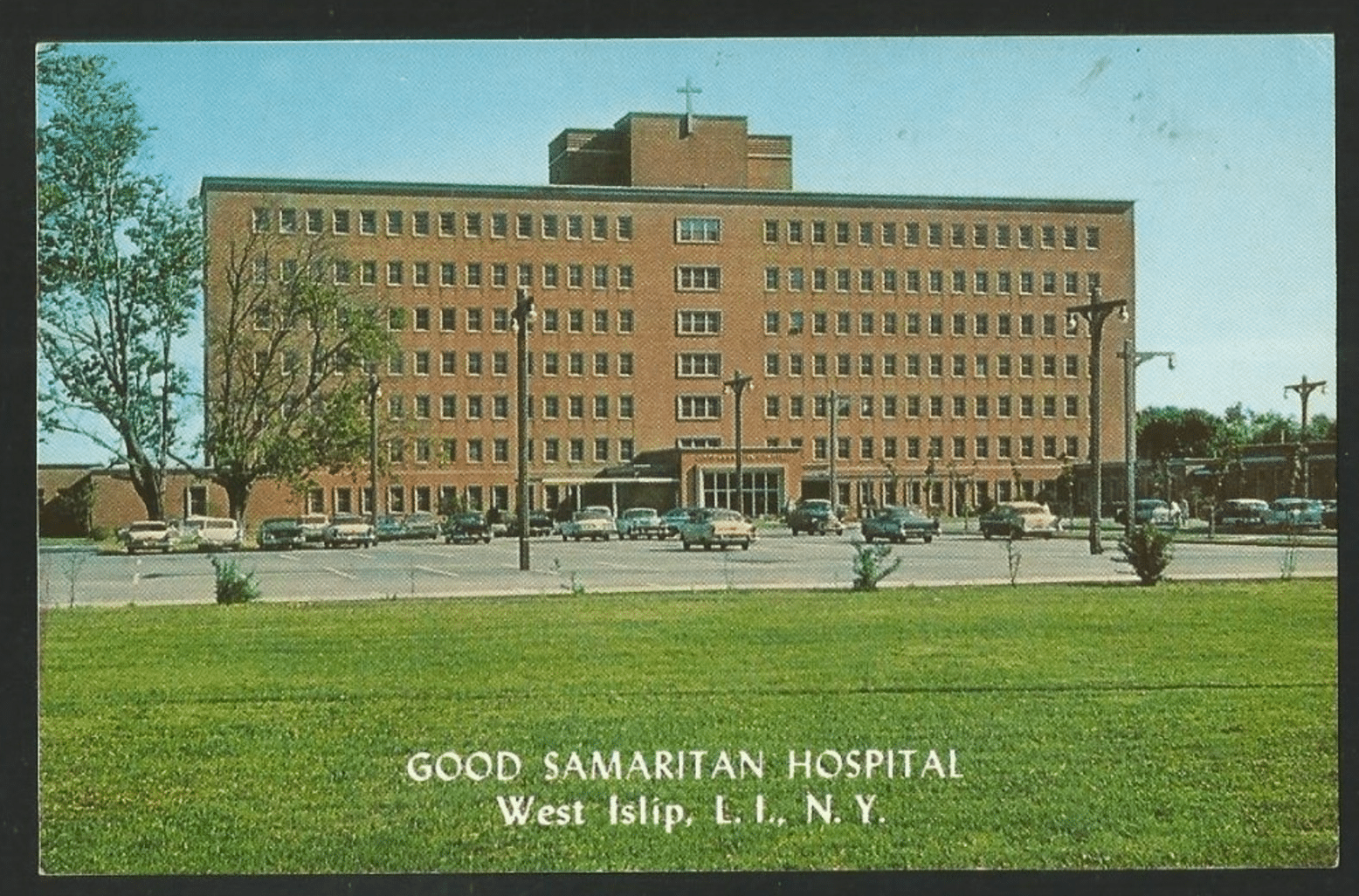

New York state has a medical debt protection law (N.Y. Pub. Health Law § 2807-k[9-a]) that prohibits discriminatory pricing by hospitals that receive state charity care funding. This law prohibits these hospitals from charging uninsured patients whose income is under 300% of the federal poverty level more than what the hospitals receive from Medicare, Medicaid, or the highest volume payer for services performed in that hospital.

New York state has a medical debt protection law (N.Y. Pub. Health Law § 2807-k[9-a]) that prohibits discriminatory pricing by hospitals that receive state charity care funding. This law prohibits these hospitals from charging uninsured patients whose income is under 300% of the federal poverty level more than what the hospitals receive from Medicare, Medicaid, or the highest volume payer for services performed in that hospital.

New York’s medical debt collection law also requires that hospitals have a written financial assistance policy that sets forth the actual sliding scale and discount rates that hospitals must provide to uninsured or underinsured consumers for medical bills. Consumers with income under the federal poverty threshold can only be required to pay a nominal amount, while consumers with incomes of 100% to 150% of poverty can be required to pay up to 20% of the amount paid by insurers for hospital services. In addition, hospitals are required to provide for payment plans, for which the monthly medical bill payment cannot exceed 10% of the patient’s gross monthly income and for which interest is limited to the rate on a ninety-day Treasury bill plus 0.5% (N.Y. Pub. Health Law § 2807-k[9-a][d]).

Other Protections Offered Under New York Law for Unpaid Medical Bills

New York law also provides debt collection protections for consumers dealing with medical debt and unpaid medical bills. If a consumer is eligible for Medicaid or is applying for financial assistance, the hospital cannot send the bill to collections during the application process (N.Y. Pub. Health Law § 2807-k[9-a][h]). The same statute provides that hospitals must provide a thirty-day notice to patients before referring a bill to a debt collector. New York law does not prohibit home liens for medical debt, but it does prohibit foreclosure on the patient’s home if you are sued for unpaid medical bills (N.Y. Pub. Health Law § 2807-k(9-a)(h)

Debt collectors must obtain the consent of the hospital before they have authority to sue for unpaid medical bills. In addition, debt collectors must follow the hospital’s financial assistance policies and provide information on such policies to consumers. Finally, New York law requires hospitals to provide notices of their financial assistance policies to consumers.

Unfortunately, compliance with New York law isn’t always followed. If you are being sued for unpaid medical bills, or if you would like to learn more about debt collection and medical bills, contact us for a free legal consultation to learn how we can help you.